Insurance

Cancellation, Travel, Medical (including Covid Enhancement) cover is available for your trip with Blue Stamp Travel to ensure that you have peace of mind when travelling.

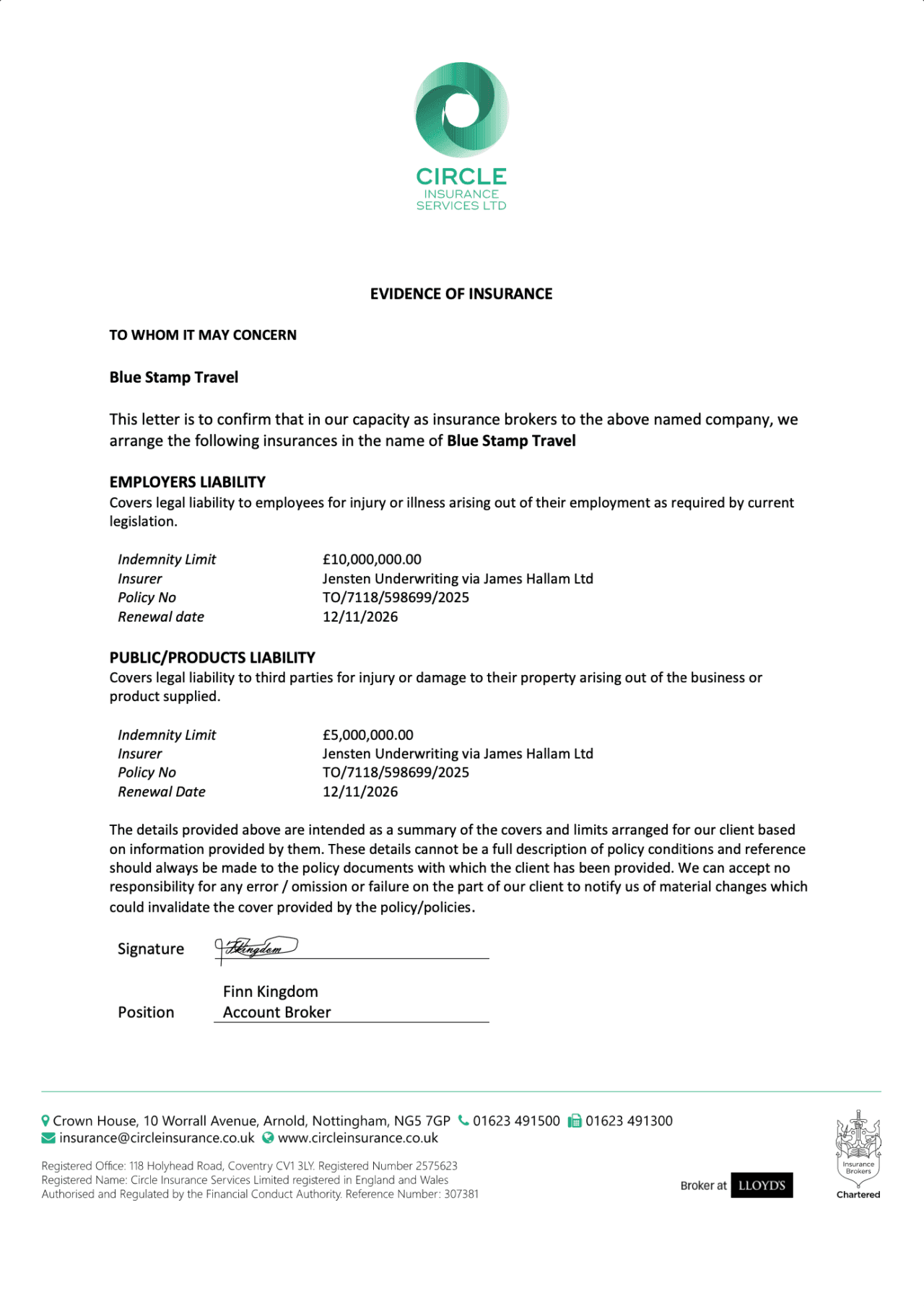

Blue Stamp Travel have all the necessary liability and tour operator insurances as you would expect from a reputable tour operator.

For individual travellers purchasing an Internship Abroad or a Work and Study package, insurance is included in your package unless you ask to have it removed. (No discount in price is offered for removing the insurance policy.) Many schools have sufficient cover provided by their school insurer for school group bookings. For this reason we offer group bookings with or without insurance included. Please ask your trip adviser for further details when you book your package. This will be detailed on quote letters.

When booking an Intensive Language Course or Host Family Accommodation (with no work element) you have the option to request insurance to be added to your trip. Blue Stamp Travel can provide this for you with our insurance provider but you should satisfy yourself that the policy provides sufficient cover to suit your needs. We are not financial advisers and do not offer advice on insurance policies other than the policy we provide.

Policies provided by Blue Stamp Travel provide cover for voluntary work experience placements (many ‘off the shelf’ travel policies would exclude work of any kind). If you would like to use your own travel policy when travelling and would like to remove this cover from your policy, please inform us at the time of booking. No reduction in the price of your trip will be made for removing cover where it is included as standard.

When accepting a policy through Blue Stamp Travel we request that you check that you are satisfied the policy provides sufficient cover and meets your personal requirements – particularly if you have pre-existing medical conditions.

A policy is taken for each traveller at the time of the first deposit to ensure that cover is in place for cancellation. Any claims should be made within 28 days of return from your travel. Although it is not essential, it may help your claim to inform us if you intend to make a claim on your policy as the insurer may require extra documentation from us. In such instances we will endeavour to support your claim to the best of our ability or offer advice accordingly.

If you would like specific information about our Insurance cover please do not hesitate to contact the insurer directly.

Your policy will take effect on the 7th of the month after you book when Blue Stamp Travel make our monthly declaration to the insurer. Exceptionally, if you book your trip more than six months prior to travelling your policy will take effect 6 months prior to your trip.

UK Government Advice on Travel Insurance

We recommend that you satisfy yourself that the insurance provided with your travel meets your requirements and encourage students to use the UK Government advice on foreign travel insurance.

We recommend that you satisfy yourself that the insurance provided with your travel meets your requirements and encourage students to use the UK Government advice on foreign travel insurance.

Guard Me

Cover is provided by Guard Me. As a trusted partner, traveller data is provided to Guard Me in order to provide cover.

Below you will find useful policy documents:

This travel insurance policy is designed to cater for the insurance needs of travellers whilst travelling on a trip arranged by Blue Stamp Travel. The product provides cover including emergency medical assistance and medical costs, protection in the event of cancellation or curtailment, cover for loss, theft of or damage to baggage and group money.

This policy has no excess in the event of a claim.

The table below displays a summary of the maximum amounts which are payable under each section. Please note the policy is subject to terms, conditions, limits and exclusions – please refer to the policy wording and the statement of insurance for full details of the cover available.

| Section | Section Details | Limit |

| Cancellation | Limit | Up to £7,500 |

| Curtailment | Limit | Up to £7,500 |

| Delayed Departure | Limit | Up to £80 |

| Per 12 hours | £20 | |

| Missed Departure | Limit | Up to £7,500 |

| Baggage Delay | Maximum after 12 hours | £100 |

| Baggage, Personal money and Travel Documents | Baggage, maximum | £ 2,000 |

| Single Article Limit | £ 250 | |

| Valuables Limit | £ 250 | |

| Personal Money, maximum | £ 250 | |

| Travel Documents, maximum | £ 250 | |

| Emergency Medical, Repatriation and Other Expenses | Limit | Up to £10,000,000 |

| Infants born following Complications of pregnancy and childbirth | Up to £75,000 | |

| Funeral Expenses or Burial Costs | Up to £5,000 | |

| Emergency Dental | Limit Up to £300 | |

| Hospital Benefit | Limit | Up to £100 |

| Payment per complete 24-hour period in hospital | £20 | |

| Personal Accident and Public Transport Accident | Limit | Up to £25,000 |

| Permanent Total Disability – aged under 18 | £5,000 | |

| Permanent Total Disability – aged 18 to 70 | £25,000 | |

| Loss of Limbs or Sight – aged under 18 | £5,000 | |

| Loss of Limbs or Sight – aged 18 to 70 | £12,500 | |

| Death Benefit – aged under 18 | £5,000 | |

| Death Benefit – aged 18 to 70 | £25,000 | |

| Personal Liability | Limit | Up to £2,000,000 |

Digital Doctor

Included as part of the cover with Guard Me is a Digital Doctor, available 24/7 online. If medical attention beyond a pharmacy visit, is required, the process is detailed in the attached document. In the first instance a video consultation is available with further guidance available if treatment is needed locally whilst out of the country.

Included as part of the cover with Guard Me is a Digital Doctor, available 24/7 online. If medical attention beyond a pharmacy visit, is required, the process is detailed in the attached document. In the first instance a video consultation is available with further guidance available if treatment is needed locally whilst out of the country.